Invest In Yourself: Private Equity CRM

A CRM system designed specifically for private equity firms revolutionizes how they manage relationships and operations. With a specialized private equity CRM, firms can centralize and organize vital information about investors, deals, and portfolios. By leveraging the capabilities of CRM for private equity, firms can effectively track and manage deal pipelines, investor communications, and fundraising efforts. SugarCRM’s platform can provide industry leaders with the valuable insights they need to empower their firm to identify trends, evaluate opportunities, and drive growth. When modern firms invest in private equity CRM, they can benefit from robust features such as customizable dashboards and reporting tools, which can lead to an increase in a firm’s ability to analyze performance, maximize efficiency, monitor investor relationships, and optimize operations.

Ditch Reporting

By analyzing vast amounts of data, Sugar’s AI capabilities identify patterns, trends, and customer behaviors, enabling the system to anticipate future actions and preferences. This predictive intelligence allows businesses to proactively engage with customers, delivering personalized experiences and tailored recommendations.

Future-Proof Your CRM Investment

There’s no slowing technology down, and you need a CRM that can keep up. Engineered in AWS, Sugar delivers more innovative and cost-effective CX initiatives for every private equity investor. Simplify your CRM world without slow or costly implementation, increase adoption by removing busy work from business, and see your profits.

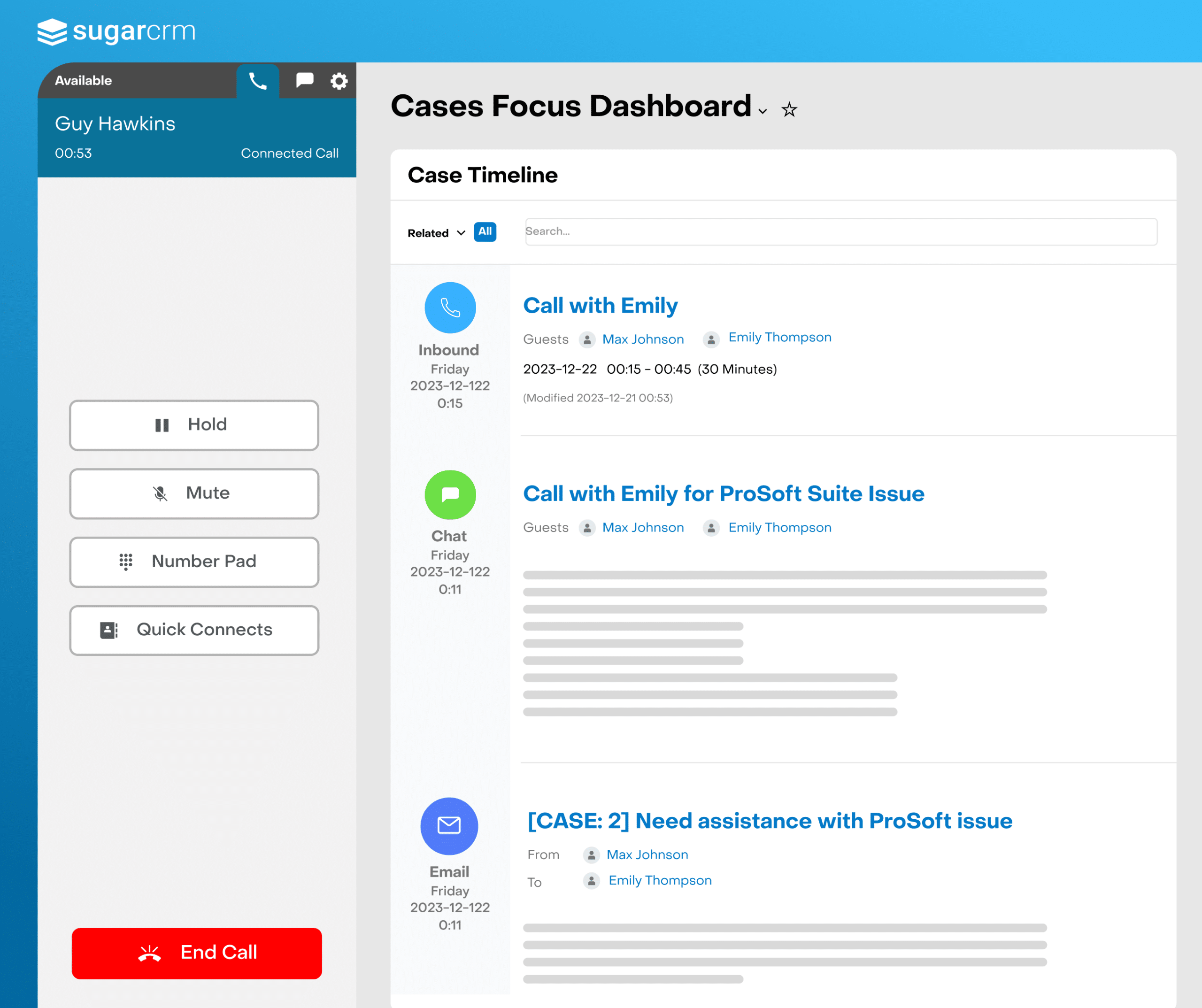

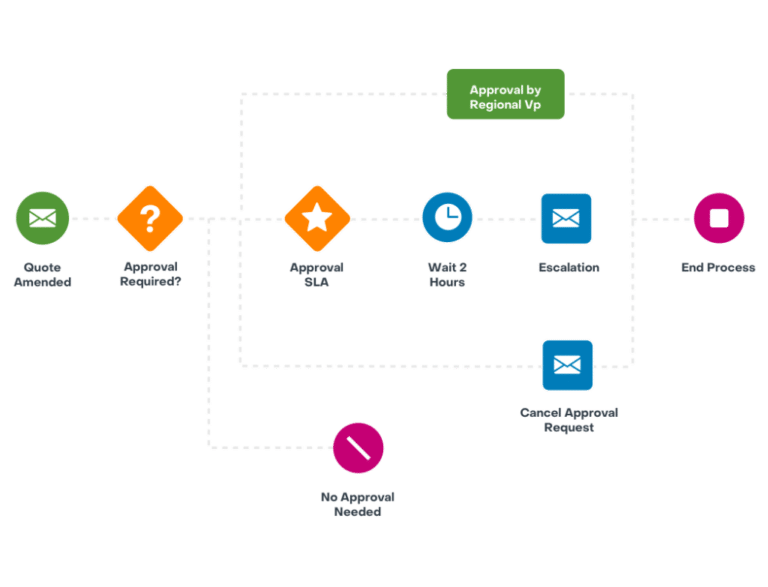

Check Items Off Your List

Increase team productivity and responsiveness by automating as many of their daily processes and routines as possible, including decision making, approval management, call triaging, task assignment, and much more.

Never Question Compliance

Meet all your organizational and regulatory requirements easily—and implement security models in accordance with data sharing and visibility requirements.