6 Things Your CRM Should Tell You About Your Credit Union Members

Many credit unions utilize legacy systems such as Symitar or Fiserv. These types of systems are used for a reason–they’ve proved for years to be unbreakable and hold critical histories of data–but they are often difficult to access, slow to load, and challenging to improve or adapt.

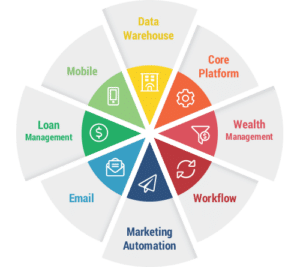

By adopting a flexible CRM platform with an integration to your core platform, you can provide your tellers and employees with a 360-degree view of the member, all with one login. Keep reading to learn six things you can learn from a platform like this.

1. A Snapshot Member Profile – We’ve always believed that your CRM should act as an anchor for your organization. Your CRM should integrate with your core tools, so you can pull information from all your systems and create a snapshot of your member that can be quickly viewed. Information should be pulled from your core platform, email client, data warehouses, wealth and loan management systems, and more. Your teller can use this profile to quickly understand who the member is and their needs during their short interaction with the member.

2. The Most Relevant Products – You can’t expect your tellers to remember each member and what their goals and needs are. But you can provide your tellers with tools that predict the offer that a member is going to be most interested in. A CRM can do this by creating custom workflows and algorithms that estimate what a member will be willing to spend based on information like their cash flow, what products they currently use and don’t use, and what offers the credit union has at the given moment.

3. The Status of Related Referrals & Incentives – If your CRM platform tracks referrals and incentives, you’ll be able to quickly tell what referrals and incentives this member has participated in. You’ll be able to see which ones they agreed to participate in, and you can also be alerted (using workflows) when an incentive is about to expire. For example, if a member has agreed to use online banking, but hasn’t used it yet, the teller would be able to see that.

4. How Marketing Has Influenced Them – Most CRMs integrate with Marketing Automation Platforms. By integrating these two key tools, you’ll be able to use that same CRM login to see what marketing efforts a member has been touched by. You’ll have better data on how successful marketing efforts are, and you’ll also know what marketing campaigns the member has responded to, further tracking the member’s interests and engagement.

5. How Satisfied they Are – Your CRM should also track a member’s open cases (i.e. support inquiries, tickets, complaints, etc.). When working with a member, your employees will be able to quickly see whether the member’s interactions with the bank are mostly positive or negative, and be able to speak to and follow up on any recent issues or experiences they may have had.

6. Whether the Credit Union is Helping Them – Is the credit union helping the member meet their financial goals? Many credit unions pride themselves on furthering their members financially but aren’t monitoring what that really means to the member and whether the members feels that they are growing. This can be tracked in CRM by first knowing and recording what their goals are (to start a business, to invest in rental property, etc.). Once this information is tracked, it can be used to make offers to members that will help them meet their goals, to congratulate members on recent goals they’ve met, and in marketing efforts to show how they help their members.

Besides these six things, there are literally tons more that your CRM should be helping you discover and learn about your members. But without a CRM that’s flexible and integrates with your core platforms, there’s no way to do this. We’ve built an integration between SugarCRM and Symitar to help you accomplish this.

To learn more about CRM for credit unions and see a demo customized for your organization, reach out to us about credit unions.