The success of every business is impacted by how happy its customers are. But in the case of credaris, company growth is tied 100% to the customer experience.

Switzerland’s largest personal loan brokerage is built around a promise to save credit seekers from the time-consuming task of visiting banks and comparing offers.

Instead of shopping around for the best loan, consumers simply fill out a web form to have professional agents do the heavy lifting for them.

This business model doesn’t just work. It works really, really well. The company regularly receives five-star ratings for its capacity to secure credit quickly, easily and free of charge. Customers frequently use words like “fast” and “uncomplicated” to describe the experience.

One reviewer characterized customer support as “very nice and competent.” Another said he likes the fact that “any adviser can provide support by looking at my details in the system, instead of me needing to explain my case every time.”

It’s the kind of feedback every company hopes to achieve. And on the surface, it would be easy to assume those reviews are the result of a straightforward process: an agent follows up on a few details and documents after someone fills out a form, and then communicates with banks to negotiate the best terms. The customer receives a credit agreement and completes the contract. It’s all completed within a day or two.

But the seeming simplicity of credaris’ approach is deceptive. In reality, the entire operation revolves around a cadence of complex behind-the-scenes activities—ones that have been carefully crafted and fine-tuned to provide the best possible customer experience.

“For a company that did not exist five years ago, we are very proud of how fast we’ve grown,” Hallauer says.

So how did they do it?

“We didn’t have a way to treat the whole customer.”

At first, the team at credaris relied on an in-house solution to maneuver the many activities required for each new loan request. The tool worked well—until the business began to take off.

In addition to ongoing customer communication, each individual account involves a large amount of paperwork to process. And if the customer were to come back for a second or third loan, the process would start all over again.

“One person could easily have multiple credit-loan request and several applications running against each,” says Hallauer. “But we didn’t have a way to treat the whole customer as such.”

After credaris’ first year, it became clear a much more robust solution was needed.

When only one CRM solution will do

From the start, credaris knew that whatever solution it chose would need to become the lifeblood of operations. It was a decision the company took very seriously. Hallauer and his team spent three months evaluating a long list of possibilities. They were looking specifically for several key components: a strong international presence, a solid implementation partner, the capacity to have data on-site and the ability to configure.

“We knew what we wanted and what we needed, but wanted it in a professional environment and needed to be able to build to our exact specifications” Hallauer explains. However, while many vendors will tell you it’s possible to configure, at the end of the day it’s just a lie.”

When evaluated against credaris’ criteria and their needs, it quickly became clear that Sugar best met the company’s requirements. “There are a lot of out-of-the-box features, which is great, but also a lot of configurations. Whatever features we needed we could build with our implementation partner,” Hallauer says.

Big Changes; Even Bigger Results

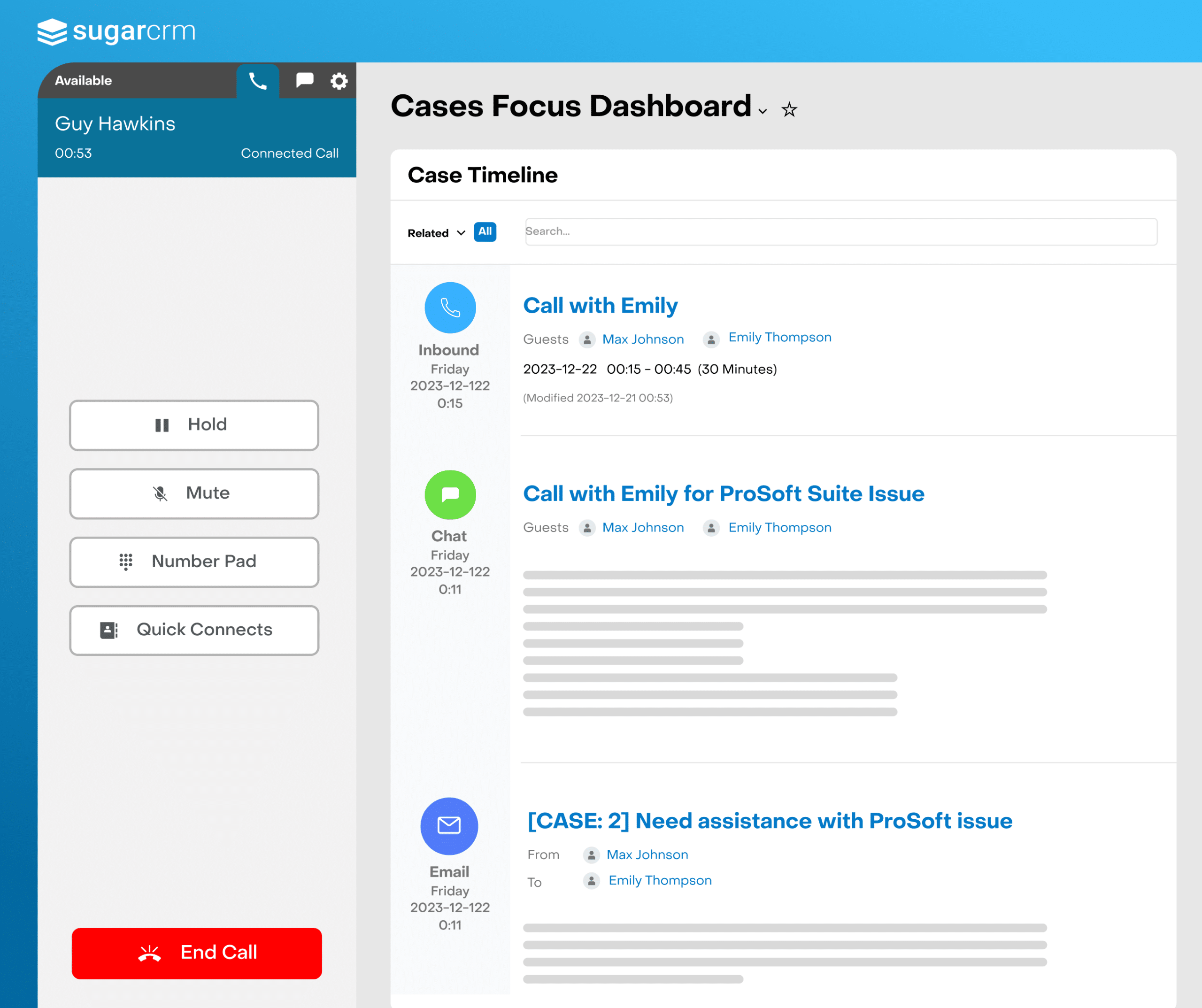

Today, all operations are powered by Sugar. For example:

- Each new lead is automatically analyzed, scored and routed to the appropriate, predetermined workflow based on the likelihood of a conversion

- Important documentation, such as scanned pay slips and customer IDs, are automatically added to the corresponding account within Sugar

- Agents use a Document Dashlet to view, drag, drop and send digitized documents without ever having to leave the CRM—a huge feature for employees tasked with managing hundreds of thousands of documents

- Any time a prospect account is missing important data, a Lead Qualification Dashlet guides the agent through a call with the customer to collect all necessary information

- Once all data and documents have been uploaded, a Risk Dashlet runs against the risk rules of each bank to identify customer eligibility for loans

At any time, credaris employees can move a lead from one automated workflow to another with a single click. So when agents are unsuccessful in reaching potential customers on the phone, for example, they simply update the account status to have a personalized follow up email automatically sent. With more than 200 workflows integrated with Sugar, it’s virtually impossible for a customer to ever be lost or forgotten.

“The workflows have made us capable at managing a high amount of leads simultaneously, without losing track of a single customer,” says Hallauer. “Without Sugar, the whole business would be down.”

Growing with Confidence

Before Sugar, more than half of credaris’ operating costs went to processing paperwork. Now everything is done digitally. With all operations managed in the same central platform, new doors are opening every day.

Recurring revenue continues to climb as existing customers turn to credaris for new loans, and the company is growing by more than 60% year-over-year—an accomplishment Hallauer says wouldn’t be possible without Sugar.

His advice? It’s not just a strong customer experience solution thatvmatters. You need to find the right partner as well. “The developers and consultants we work with are just really, really good” at configuring Sugar to meet credaris’ needs, he says. “Investing in customers this way is really worth it. It’s a miracle. And it

makes us really, really effective.”

Sugar Partner

Comza is dedicated to Sales-Excellence [SLX]. We believe in SLX being an integrated, continuously improved and systematic way of SalesManagement. SLX provides Sales-Enablement by leveraging omnichannel Customer Interaction.